The 1%

To be in the top 1% of net worth globally, you’d need a minimum of around $936,430, according to the 2019 Global Wealth Report from Credit Suisse.

To be in the top 1% of net worth globally, you’d need a minimum of around $936,430, according to the 2019 Global Wealth Report from Credit Suisse.

The term “The 1%” is slung around with razor-edged contempt. Every iteration is meant to be pejorative in tone and context. Why? Who are these 1%ers?

What do the available statistics say about the 1%? Are they the diabolical, money-grubbing Mr. Potter’s of the world? Or the very select, uber elites living immersed in the lifestyles of the rich and fabulous? Or are the 1% just high-achievers like you and me, who made it through the exhausting pursuit of better with a big bag of money to show for their efforts? Say an innovator like Steve Jobs?

Or did you have the inherited wealth of a Hilton or a Rockefeller in your sights?

Let’s start by slicing and dicing “The 1%” like a sushi chef at happy hour. First, separate the top 1% of all earners from the top 1% of all wealth. Given the vigorous debate about the statistics of the 1%, where they are sourced and the conclusions are drawn from the data, let’s agree to generalize.

Top 1% By Earnings

To be in the top 1% of earners in the U.S., you’d need to pull in $758,434 a year, based on recent data. Keep in mind that the average worker in the U.S. earns just $57,535. The top 1% of earners in the U.S. earn more than 19 times more than the bottom 90% of earners, according to one research group.

The sacrifice required to regularly earn almost seven figures is enormous. Of course, the perks can be staggeringly cool. Private jets. Gourmet food. The best of everything. But you toil for your supper. By contrast, the 1% by net worth is much more revealing.

Top 1% By Net Worth

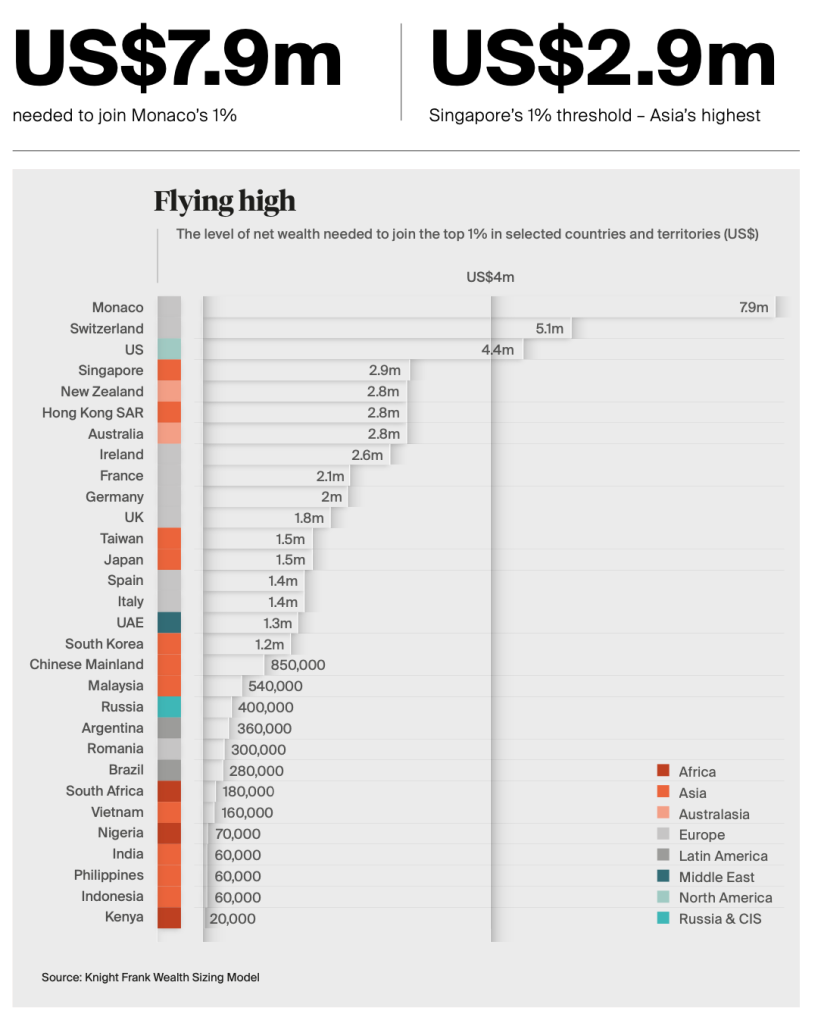

To be in the top 1% of household wealth in the U.S., you’d need to be worth at least $10,374,030.10, according to Forbes. However, Knight Frank’s Wealth model has the figure lower at $4,400,000. Opinions and data vary. To be in the top 1% globally, you’d need a minimum of around $936,430, according to the 2019 Global Wealth Report from Credit Suisse. The difference reflects, in part, decades in which the U.S. economy was the world’s strongest and, thus, for many years Americans were accumulating wealth at a higher rate than residents of other countries,

For the top 10% in the U.S., the minimum is $1,182,390.36 but for the 0.10%, the minimum is $43,090,281.

While the net worth of the top 1% in America continues to rise, the rate at which it is rising is declining, according to the Credit Suisse Global Wealth Report 2019. Rising uncertainties and tensions in the U.S. over the last few years – a trade war with China, the tension in the Middle East, stock-market volatility, and concern about mounting government debt – may be reflected in recent decelerating wealth growth, according to the Swiss bank’s report. Wealth per adult rose just 3% in the 12 months to mid-2019, compared to an average annual increase of 5% in the previous five years.

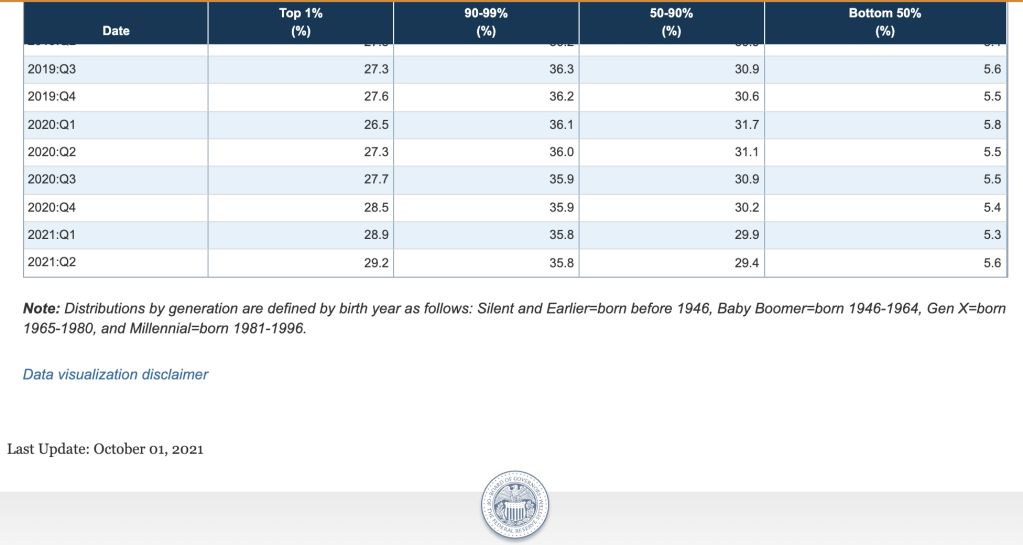

The richest 1% of Americans are not just experiencing growing wealth, they also are experiencing a growing slice of the nation’s overall wealth, according to the Federal Reserve. The wealth share of the top 1% climbed from 36.3% in 2013 to 38.6% in 2016, slightly surpassing the wealth share of the next highest 9% of families combined.

Who are the top 1% by country. Knight Frank has an answer. Monaco is the global center of wealth with the highest bar to membership into the 1% at $7,900,000.

I can’t pass up the opportunity to take a macro view of “The 1%”. A funny thing happened over the last 100 years. An idea caught on as empires ended. The notion of equity between the “have’s and the have not’s” in our global society tore the world into pieces. Two world wars. Millions dead as two competing ideologies rose from the ashes of empires threatening to end mankind (the cold war) in their battle for supremacy for who decides how to create “equity” in a society.

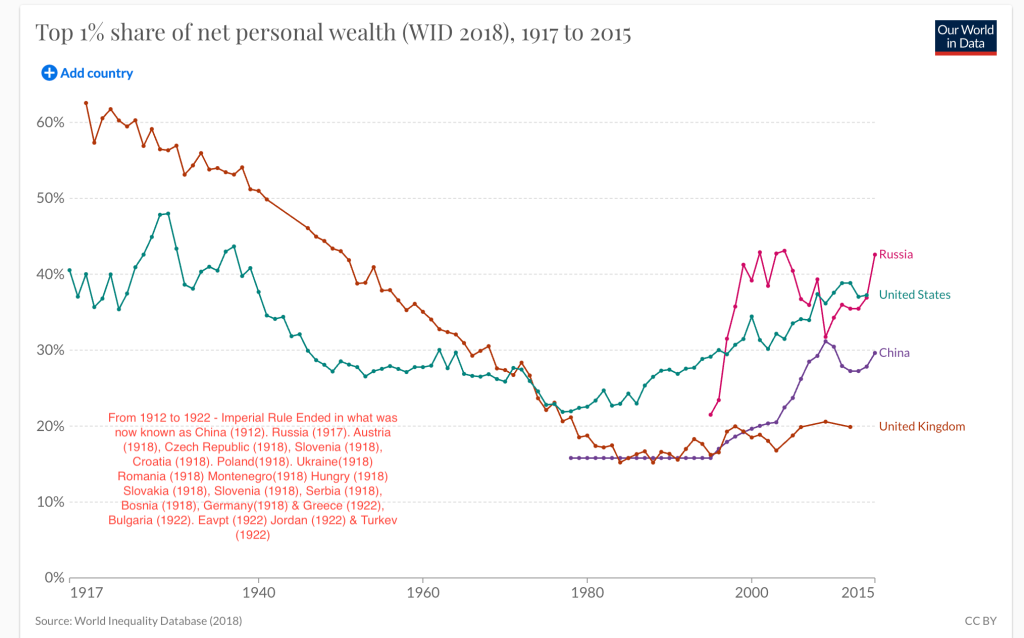

Looking at the graphic below (Top 1% Share of Net Personal Wealth) provided by my friends at Oxford and annotated by yours truly to drive home a point. The idea of equity tragically championed by Marx, Lenin, and Mao caught fire elsewhere in a more tame manifestation. The long-term trend began a steady decline in the US and the UK after empires. At the End of History and the Last Man in 1998, the two fierce ideological competitors arrived at the same juncture minus the millions killed in internal struggles and purges. Thank you, Chairman Mao & Comrade Stalin, for your contributions to genocide and to political thought.

America will have to come to terms with the upward trend in “the 1%” share of the pie beginning around 1980. For all you big government fans, please remember the long-term trend down in “The 1%’s” wealth began when the US government was smaller and vastly less intrusive in our daily lives. And, I would be remiss if I failed to say, the Chinese and the Russians tried the big government route to equity. And failed. Miserably. Big government or socialism (communism) fosters a gray, dystopian world devoid of hope. Take my word for it. I was there.

Maybe we should take a lesson from our British friends. They found stable equity after empire. The UK switched from a more socialist model adopted in 1945 to a balanced approach under Thatcher. As far as equity and “The 1%’s”, the UK seems to have found a happy place. For now.

Before we wrap up this post I want to indulge your inner hedonist. Let’s have coffee and a light breakfast together in the shadow of the Brandenburg Gate. The old front line of that ideological battle referred to as the Cold War. I appreciate the new polished vision of the “Friedenstor”, or “Peace Gate” as it was originally named with less barbwire and fewer weapons pointed at me.

In the final analysis, the numbers don’t lie. We have it pretty good in the United States.